Deductible Business Expenses 2024 Meaning – Ready or not, the 2024 tax filing season is here. As of January 29, the IRS is accepting and processing tax returns for 2023. The agency expects more than 128 million returns to be filed before the . According to the IRS, though, an audit is simply a review of your accounts “to ensure information is reported correctly according to the tax laws and to verify the reported amount .

Deductible Business Expenses 2024 Meaning

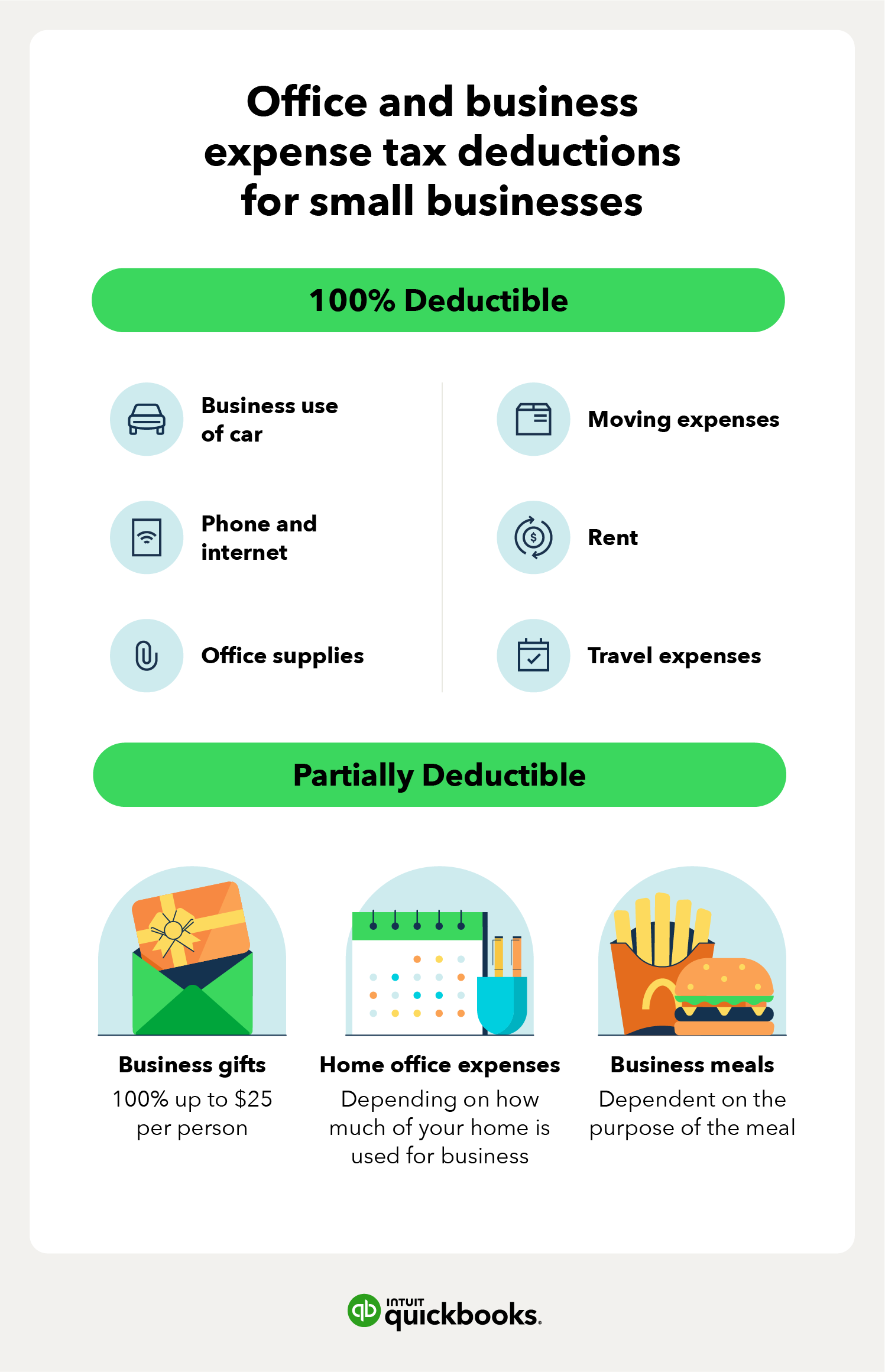

Source : www.freshbooks.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

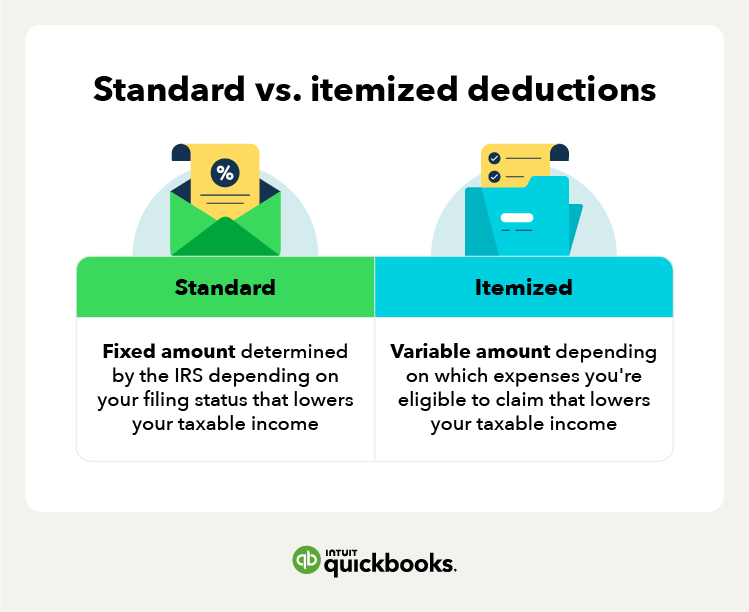

Source : quickbooks.intuit.comTax Deduction Definition: Standard or Itemized?

Source : www.investopedia.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.com2024 01/18 Deducting advertising costs for businesses EG

Source : egconleyblog.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comDr.Inc. (@DrInc9) / X

Source : twitter.comSmall Business Expenses & Tax Deductions (2023) | QuickBooks

Source : quickbooks.intuit.comSection 179: Definition, How It Works, and Example

Source : www.investopedia.comMark R. Stanhope CPA PC | Hudson MA

Source : m.facebook.comDeductible Business Expenses 2024 Meaning 25 Small Business Tax Deductions To Know in 2024: The TRAFW Act would increase the amount of business interest that a taxpayer can deduct for tax years beginning after For qualifying property placed in service in 2024, a taxpayer may expense up . The best banks for small businesses offer specialized accounts, competitive interest rates and a suite of tools for growing companies. We’ve compared 60 financial institutions to pinpoint the best .

]]>

:max_bytes(150000):strip_icc()/tax-deduction.asp-Final-163716aa2a244bac8f059f5e289bf913.png)

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)

:max_bytes(150000):strip_icc()/Term-Definitions_Section-179-resized-1a04b9f84c4d4141b11d1d9ca10fb981.jpg)